QuickPay is a payment solution that provides several benefits for merchants and customers alike. In this blog post, we will discuss the advantages of NCB QuickPay and how it can help businesses improve their payment processes.

National Commercial Bank (NCB) has recently launched a new service called QuickPay, which aims to make banking transactions quicker and more convenient for their customers.

With QuickPay, NCB Personal Banking customers can transfer money to other NCB accounts, pay their credit card bills, and settle utility bills, all in a matter of seconds.

Benefits of QuickPay

In addition to being convenient and accessible, QuickPay is also secure.

QuickPay can be accessed through the NCB Mobile app, which is available for both iOS and Android devices.

- QuickPay eliminates the need for customers to visit a physical branch or ATM to complete their transactions through NCB Mobile app.

- QuickPay is available 24/7, which means that customers can perform transactions at any time of the day or night.

- NCB includes two-factor authentication for security measures.

- One of the main benefits of QuickPay is its speed.

- QuickPay also offers a range of payment options, including credit and debit card payments, bank transfers, and mobile payments.

- QuickPay offers advanced reporting and analytics tools, allowing merchants to track sales and monitor transaction data in real-time.

With QuickPay, merchants can process payments quickly and easily, reducing the risk of delayed or missed payments.

NCB QuickPay Account

If you are already a NCB QuickPay account holder you are already registered in the Quick Pay service, visit any of our Quick Pay centers to register your beneficiary.

If you are not familiar then no worries go through our NCB account registration guide.

If you are not a Quick Pay account holder, visit any of our Quick Pay centers with a Valid Iqama/ID to open an account and receive the Quick Pay ATM card.

Account Registration

Opening a Quick Pay account is a simple process that can be done in a few easy steps.

- Go to Nearest QuickPay center

- Give your Iqama and Submit Salary Certificate if needed.

- Complete application form.

- Receive the Quick Pay ATM card.

Registering with AlAhli Phone Banking

- Insert ATM card.

- Choose your language.

- Enter the 4- digits secret Pin number. Then Press ACCEPT.

- Press “Other transaction” button.

- Press Al Ahli Phone Banking: button.

- Click on Issue or Change pin button.

- Press Accept button.

- Enter AlAhli Phone Banking pin then press Accept button.

Register either through the Quick Pay call center 920000330 or through AlAhli Online.

Be sure to register your beneficiaries to be able to send money anytime using any NCB Electronic Channels (ATMs, Alahli Online, Alahli Mobile or Phone Banking).

How to Deposit Money after account registration?

After account creation now if you want to deposit money, just follow our steps like,

- Visit any NCB ATM and insert ATM card.

- Choose your language.

- Enter the 4- digits secret Pin number. Then Press ACCEPT.

- Press “Deposit” button.

- Press YES button.

- Insert Cash into ATM machine.

- Press Accept button.

- Enter No button and deposit done.

Transfer Funds from QuickPay

Sending money through Quick Pay is a convenient and fast way to transfer funds to someone else.

Download application of NCB QuickPay into your phone.

By following these steps, you can quickly and safely transfer funds to someone else.

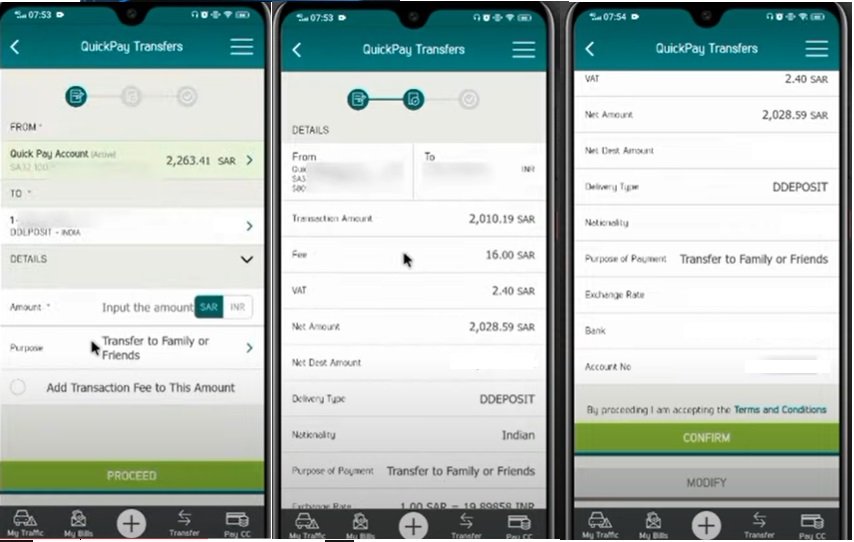

Step 1: Log in to your online NCB account.

Step 2: Select Transfer then Quick Pay.

Step 3: Choose the Beneficiary (Add new Beneficiary first).

Step 4: Enter details of Beneficiary.

Step 5: Enter Amount to be send to beneficiary.

Step 6: Give reason as Purpose of Transfer

Step 6: Then confirm your Transaction

And that’s it!

The recipient will receive an email or text message notifying them of the payment, and the funds will be transferred to their bank account once they accept the payment.

Limitation of Quick Pay transactions

The limit for Quick Pay transactions varies from bank to bank, but in general, there are both daily and monthly limits in place.

Like as NCB QuickPay maximum amount Transfer limit is about 100,000/month.

These limits are designed to prevent fraud and ensure that customers are protected from unauthorized transactions.

Once the transfer is initiated, the funds will typically be available in the recipient’s account within minutes.

However, it’s important to note that some banks may hold the funds for a short period of time to ensure that the transfer is legitimate.

Use QuickPay Customer Service

QuickPay is a fast and efficient way to transfer money online, but sometimes you may have questions or issues that require the assistance of customer service.

To contact QuickPay customer service, you can visit their website and navigate to the “Contact Us” page.

From there, you can choose to send an email or call their customer service hotline.

Conclusion

QuickPay is a powerful payment solution that offers a range of benefits for both customers and merchants. With its speed, security, and flexibility, QuickPay can help businesses improve their payment processes and provide a better shopping experience for their customers. QuickPay is a convenient way to transfer money online, and their customer service team is available to assist with any questions or issues you may encounter. By following the simple steps outlined above, you can easily use QuickPay to transfer money to your friends and family.

F.A.Q’s

Where do I claim QuickPay?

The Quick Pay Service can be accessed using the Remittance Membership through SNB ATMs, Alahli Online, Alahli Mobile and Alahli Phone Banking.

How much is one riyal in Pakistan quick pay?

1 SAR=76.5824 PKR

How much time taken by QuickPay?

Quick pay is a good option if all you need is cash quickly and only use it once in a while.

Why is QuickPay showing pending?

If the payment status is pending, the recipient may not have enrolled their phone number or email address.

At this point, you have the option to cancel the payment. When the payment status is completed, the money has already been deposited into the recipient’s bank account.