In Saudi Arabia, there are several services for transferring and receiving money, but which one is the best? Money transfer services is an essential aspect of modern life, especially for people living and working abroad who wants to send money.

Money transfer is an essential aspect of financial transactions, especially in a country like Saudi Arabia, where a significant number of expatriates reside.

With the growing need for international money transfers, several banks have come up with their transfer services.

However, choosing the right way that meets your needs can be challenging.

In this blog post, we will discuss the best money transfer options in Saudi Arabia.

International Transfer of Money from Saudi Arabia

Firstly, we are going to explore the different money transfer options which are available in Saudi Arabia and provide insights into the best options for international transfers, sending money to Pakistan, and transferring money from Pakistan to Saudi Arabia.

From Pakistan to Saudi Arabia

If you need to send money from Pakistan to Saudi Arabia, there are several options available, including bank transfers, money transfer companies, and online platforms.

The best way to send money from Pakistan to Saudi Arabia is through a reliable money transfer company like Western Union or MoneyGram.

These companies offer fast transfer times, competitive exchange rates, and secure transactions.

When it comes to international transfers, the best banks in Saudi Arabia are Al Rajhi Bank, National Commercial Bank (NCB), and Saudi British Bank (SABB).

These banks offer competitive exchange rates, low fees, and efficient processing times.

However, it’s important to note that fees and exchange rates can vary depending on the amount of money being transferred and the destination country.

From India to Saudi Arabia

When it comes to money transfer in India, there are several options available, including banks, money transfer companies, and online platforms.

The best money transfer company in India is Remit2India, which offers competitive exchange rates, low fees, and fast transfer times.

Always compare rates and fees before making a final decision.

When it comes to international transfers, we can do through banks or also with multiple applications that are specifically made for our ease.

Start with transfer of money through banks.

Money Transfer from Banks

Choosing the right bank for international money transfers in Saudi Arabia can be a daunting task.

However, with the options mentioned above, you can make an informed decision.

Al Rajhi Bank, SAMA, NCB, and Riyad Bank offer reliable, secure, and cost-effective transfer services.

The following banks offer the best money transfer services in Saudi Arabia:

Al Rajhi Bank

Al Rajhi Bank provides excellent exchange rates for international transfers.

Their online platform is easy to use and offers competitive fees for transferring money abroad.

Additionally, they have a vast network of branches across the country, making it convenient to access their services.

As one of the largest banks in Saudi Arabia, Al Rajhi Bank offers a range of domestic and international money transfer services.

They have an extensive network of branches and ATMs, making it convenient for many people.

If you want to know more about account creation, benefits and other services that Al-Rajhi is given go through details in our guide of Al-Rajhi Bank.

Arab National Bank (ANB)

Arab National Bank (ANB) is a prominent bank in Saudi Arabia that offers international money transfer services.

They provide options for sending funds abroad through telegraphic transfers, drafts, and online banking platforms.

ANB has correspondent banking relationships worldwide, facilitating secure and timely international transfers.

Saudi Arabian Monetary Authority (SAMA)

Saudi Arabian Monetary Authority (SAMA) is the central bank of Saudi Arabia and provides a secure and efficient system for international money transfers.

They offer a platform called SADAD, which allows you to transfer money to more than 200 countries at competitive exchange rates.

They regulate and oversee the banking sector, ensuring the safety and efficiency of money transfers within Saudi Arabia.

National Commercial Bank (NCB)

National Commercial Bank (NCB) is one of the largest banks in Saudi Arabia and offers a reliable and secure platform for international money transfers.

They provide competitive exchange rates and low fees, making them an excellent choice for expatriates.

Riyad Bank

Riyad Bank provides excellent exchange rates and low fees for international money transfers.

They have a user-friendly online platform that is easy to navigate, making it convenient for customers to send money abroad.

If you want to know more about account creation, benefits and other services that Riyad bank is given go through details in our guide of Riyad Bank.

Alinma Bank

Alinma Bank is a leading Islamic bank in Saudi Arabia that offers convenient and secure money transfer services.

They provide options for both domestic and international transfers, including online banking and mobile applications.

Money Transfer from Online applications

Sending money between countries has become more accessible in recent years, thanks to the rise of digital payment platforms.

For those looking to send money from Saudi Arabia to Pakistan, there are several options to choose from.

When choosing a money transfer company, it’s important to compare factors such as transfer fees, exchange rates, transfer limits, transfer methods, and customer reviews.

Additionally, consider the convenience of registration and the availability of local support or customer service in both India, Pakistan, and Saudi Arabia

In this blog post, we will discuss the best app to send money to Pakistan from Saudi Arabia and the process of sending money from Pakistan to KSA.

Xpress Money app

Xpress Money is a global remittance service that operates in several countries, including Pakistan and Saudi Arabia. For sending money to Pakistan from Saudi Arabia, the best app is the Xpress Money app. They offer multiple ways to send money, such as bank transfers, cash pickups, and mobile wallet transfers. Xpress Money has an extensive network of agent locations in both Pakistan and Saudi Arabia. It offers competitive exchange rates and low fees, making it an affordable option for sending money to Pakistan. It allows users to send money to over 165 countries worldwide, including Pakistan. Xpress Money is known for its fast and secure transfer process, with funds usually delivered within minutes.

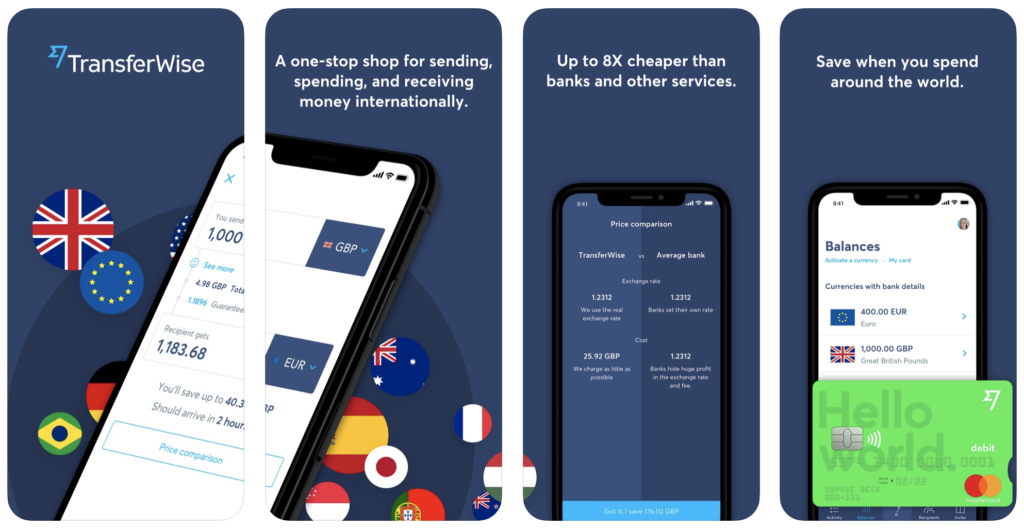

TransferWise

If you are looking for a company with more advanced technology, you might consider using TransferWise. TransferWise is a well-known international money transfer service that offers competitive exchange rates and transparent fees. It allows you to send money from Pakistan to Saudi Arabia using its online platform or mobile app. TransferWise is known for its fast transfers and low-cost transactions. They use a peer-to-peer system that allows you to send money at the mid-market exchange rate, which can save you money compared to other services. TransferWise also offers a mobile app and a website that are easy to use.

Western Union

To send money from Pakistan to KSA, there are several options available. Another option is to use a money transfer company is Western Union. These companies offer fast and secure transfer services with competitive exchange rates. They also have a vast network of agents and branches in both Pakistan and KSA, making it easier to send and receive money. They have a large network of agents and offices in both India and Pakistan, making it easy to send and receive money. The fees for Western Union are also relatively low, making it an attractive option for many people.

PayPal

PayPal is a widely recognized digital payment platform that enables secure online transactions and money transfers. It allows individuals and businesses to send and receive money internationally, making it a popular choice for online transactions.

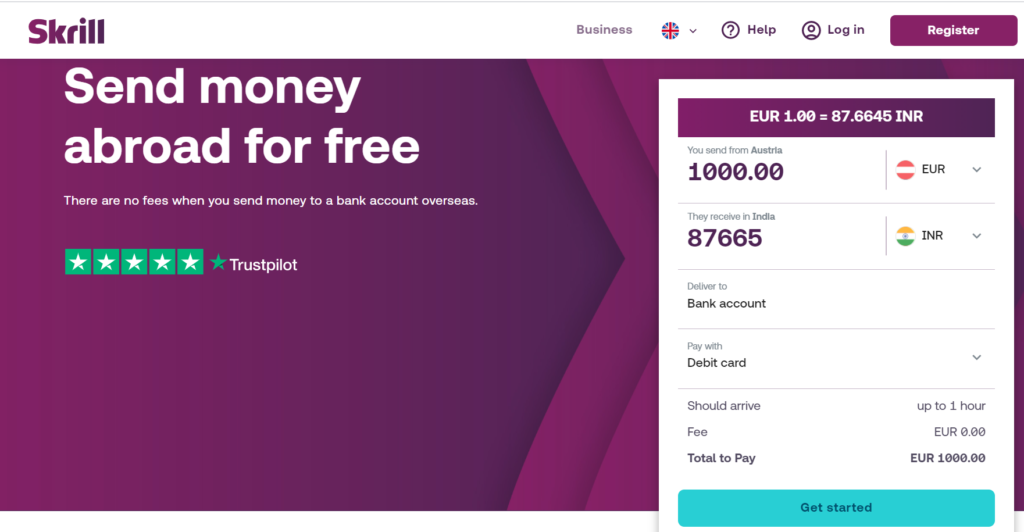

Skrill

Skrill is a digital wallet and payment platform that allows users to send and receive money internationally. You can fund your Skrill account from Pakistan and transfer the funds to a recipient in Saudi Arabia. Skrill supports instant money transfers and provides a user-friendly website and mobile app.

WorldRemit

WorldRemit is a digital money transfer platform that enables individuals to send money internationally, including from Pakistan to Saudi Arabia. It offers multiple transfer options, including bank deposits, cash pickups, and mobile wallet transfers. WorldRemit provides a user-friendly website and mobile app for convenient transactions.

MoneyGram

Another company that offers money transfer services is MoneyGram. They have a similar network of agents and offices, and their fees are also competitive. MoneyGram also offers a mobile app that allows you to send money from your phone, which can be very convenient.

Xoom

Finally, if you are looking for a company that specializes in international money transfers, you might consider using Xoom. They offer services in over 130 countries, including India, Pakistan, and KSA. Xoom also guarantees that your money will arrive on time, or they will refund your fees.

Which documents are needed at time of transfer money?

To send money from Pakistan to KSA through a money transfer company, you will need to provide some personal information, including your name, contact details, and a valid ID.

You will also need to provide the recipient’s name, contact details, and bank account information.

Once you have provided the necessary information and completed the transfer, the funds will be sent to the recipient’s bank account in KSA.

Before choosing an app or website, compare factors such as transfer fees, exchange rates, transfer limits, transfer methods, and customer reviews. Additionally, consider the convenience of registration and the availability of local support or customer service in both Pakistan and Saudi Arabia.

General Process to Transfer Money Internationally

To send money from Pakistan to Saudi Arabia, you can follow these general steps:

Step 1: Choose a money transfer service

Research and compare different money transfer services available in Pakistan that offer transfers to Saudi Arabia. Consider factors such as transfer fees, exchange rates, transfer speed, and convenience

Step 2: Register and Create an account

Sign up for an account with the selected money transfer service. You may need to provide personal information and documentation as per the requirements of the service provider.

Step 3: Provide recipient details

Enter the recipient’s details, including their full name, contact information, and bank account details in Saudi Arabia. Make sure to double-check the accuracy of the information to avoid any issues with the transfer.

Step 4: Specify the transfer amount

Indicate the amount of money you wish to send in Pakistani Rupees (PKR) or Saudi Arabian Riyals (SAR). Pay attention to any minimum or maximum limits set by the money transfer service.

Step 5: Review and confirm the transaction

Carefully review all the details of the transaction, including fees, exchange rates, and transfer details. If everything is accurate, proceed to confirm the transfer.

Step 6: Fund the transfer

Depending on the money transfer service, you may need to fund the transfer by depositing the money into the service provider’s bank account or using alternative payment methods available.

Step 7: Track the transfer

After initiating the transfer, the money transfer service may provide a tracking or reference number. Keep this information safe, as it can be used to track the progress of the transfer.

Step 8: Notify the recipient

Inform the recipient in Saudi Arabia that you have initiated the transfer. Provide them with any relevant information, such as the tracking number or any additional details required for them to receive the funds.

Step 9: Confirm receipt of funds

Once the recipient receives the money in Saudi Arabia, they should confirm the successful receipt. You may also receive a confirmation notification from the money transfer service.

Remember to comply with any regulations and requirements set by both the Pakistani and Saudi Arabian governments regarding money transfers, including reporting and documentation procedures.

It’s always advisable to consult with the chosen money transfer service for specific instructions and any additional steps that may be required.

We hope this guide has been helpful for you and made the process simpler. Good luck!

If you have any further questions, please do not hesitate to contact us.