Ready to buy your new car in Saudi Arabia? Congratulations!

Or, buying a motor insurance for a car you already have?

How about if I tell you that I have found an amazing insurance aggregator called “Tameeni Car Insurance” where you can find the cheapest car insurance and also can compare with various (almost 20) of insurance companies.

All of this, with transparency.

So, let’s get straight to the point and let me help you in finding the cheapest car insurance online which is hassle-free!

What is Tameeni Car Insurance?

Let me explain you first that what Tameeni car insurance is exactly?

Tameeni Car Insurance is an online insurance aggregator that provides a convenient platform for comparing and purchasing motor insurance in Saudi Arabia.

By partnering with over 20 leading insurance companies, Tameeni offers a wide range of insurance options to suit the diverse needs of Saudi Arabian motorists.

How Does Tameeni Car Insurance Work?

Tameeni Insurance streamlines the process of comparing motor insurance prices by enabling you to enter your vehicle details and insurance requirements once, after which the platform automatically generates quotes from multiple insurance providers.

This eliminates the need to visit individual insurance company websites and fill out multiple forms.

I’m going to state a complete step-by-step process down below which going to help in finding a cheapest car insurance online using Tameeni.

Benefits of Using Tameeni Car Insurance

Comparing motor insurance prices through Tameeni Insurance offers several benefits, including:

Convenience

Compare quotes from multiple insurance companies in a single platform.

Transparency

View detailed information about each insurance policy and its coverage.

Impartiality

Receive unbiased recommendations based on your specific needs.

Savings

Find the most affordable insurance option that meets your requirements.

Ease of Use

The platform is user-friendly and easy to navigate.

Factors Affecting Motor Insurance Prices in Saudi Arabia

Several factors influence the cost of motor insurance in Saudi Arabia, let me tell you few of them:

Vehicle Type

Insurance premiums are higher for more expensive and higher-risk vehicles.

Vehicle Age

Newer vehicles typically have higher insurance premiums.

Driver Age and Experience

Younger and less experienced drivers are generally charged higher premiums.

Driving Record

A history of accidents or traffic violations can lead to higher premiums.

Coverage Level

Comprehensive coverage, which includes protection against own-vehicle damage, is more expensive than third-party liability insurance, which only covers damage to other vehicles.

Location

Vehicles registered in areas with higher traffic congestion or crime rates may have higher premiums.

Comparing Motor Insurance Prices on Tameeni Car Insurance

To compare motor insurance prices on Tameeni Insurance, follow these steps:

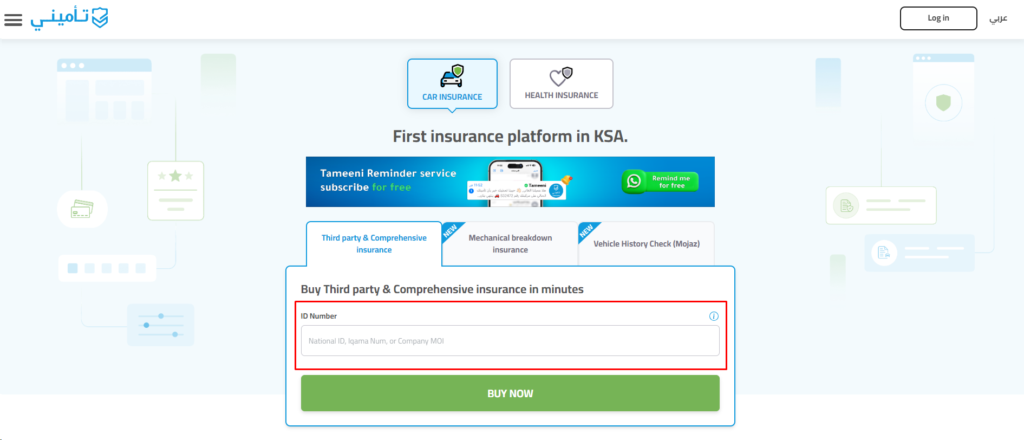

- Visit the Tameeni website or download a mobile application from App Store or Google Play Store. (In my case, I’m using a website and going to guide you with screenshots.)

- Choose your preferred language from the upper left corner. (I chose, English.)

- Enter your ID or Iqama number: As shown in the image below.

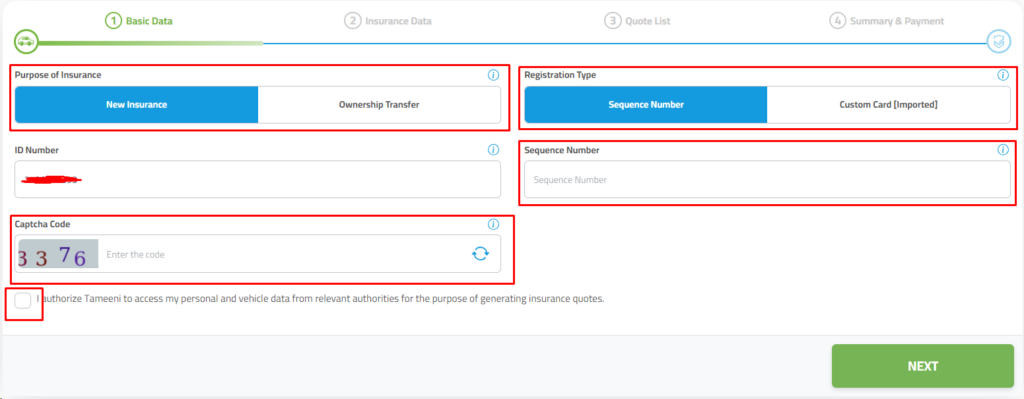

- Select Purpose of Insurance: New insurance means the vehicle is under the ownership of you and you’re buying for it or Ownership transfer which means you’re buying a vehicle and getting an insurance for it before transferring ownership.

- Select Registration Type: Until and unless your vehicle is imported, ignore it.

- Enter your vehicle Sequence Number: This can be found in your istimara / vehicle registration card or digitally through Absher digital card.

- Here is a complete guide on finding your vehicle sequence number: How to Find Your Vehicle Sequence Number (VSN) in KSA

- Enter the captcha code shown in the image.

- Click on Tick: This is to authorize Tameeni to access your date for finding the quotes from the insurance companies.

- Now Click “Next” button: You can find this at your right bottom which is a green button.

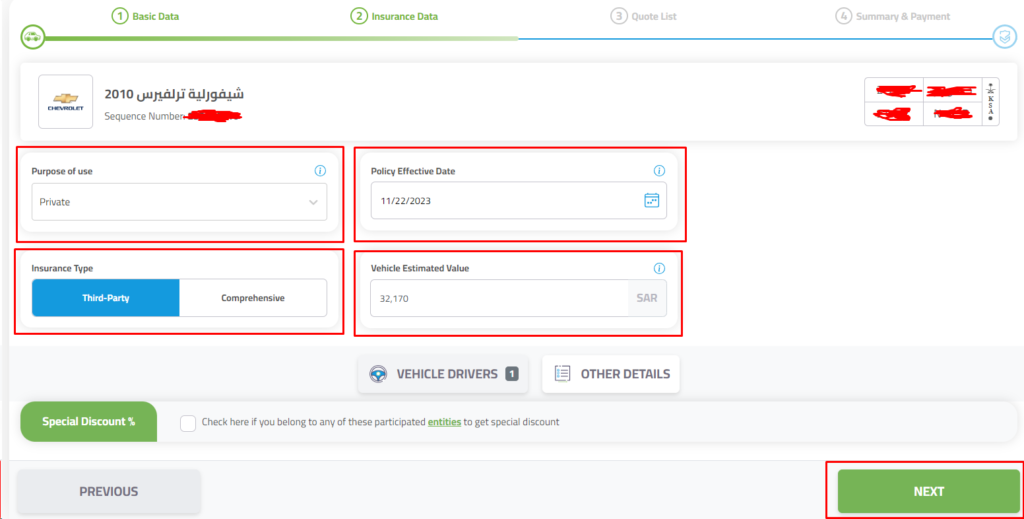

- Select Purpose of use: In my case, I selected Private as that’s my private vehicle.

- Select Policy effective Date: You can select the effectiveness of the policy for any date, not just same date.

- Select Insurance type: You can have comprehensive which means insurance for third party and your car or you can select third-party.

- Add the estimated value of your vehicle: It will give you by default a value but if you want to add your price, you can.

- Now Click “Next” button: You can find this at your right bottom which is a green button.

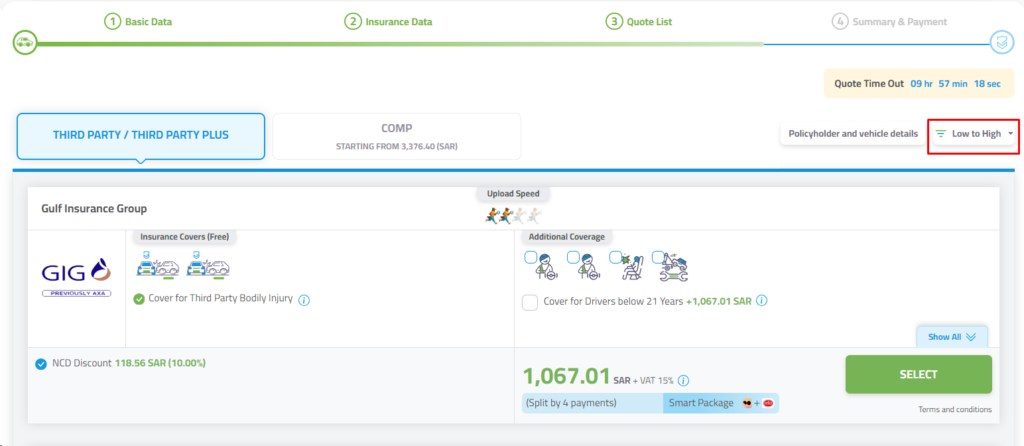

- Select your suitable option by clicking “Select” button: On the next screen, you can see all the quotes, select one of them, it’s better to sort it by “low to high” so you find the cheapest car insurance easily.

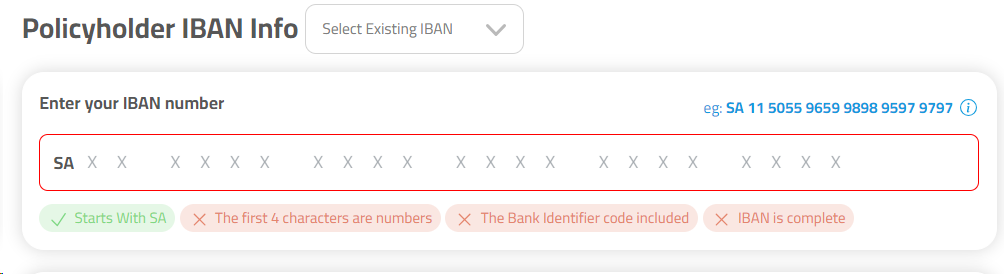

- Now enter your IBAN number: It will be appear on the following screen.

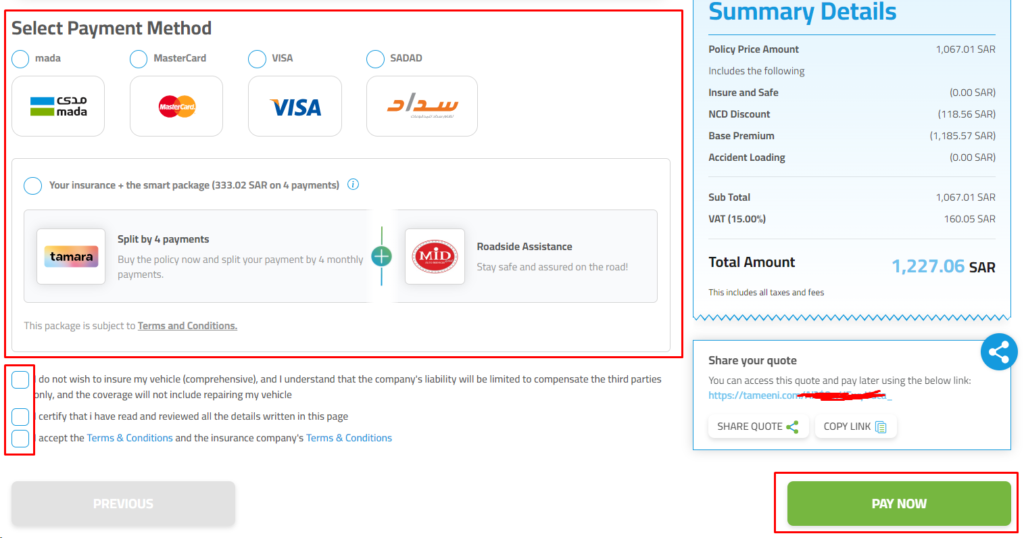

- Select your payment method: Scroll down little bit and from payment methods, select one of them.

- Note: You can also split the payment into 4 payments using Tamara.

- Tick all the terms and conditions: Don’t forget to read them.

- Click the “Pay Now” button to pay: Congratulations! you have saved your hard-earned-money and bought the cheapest car insurance using Tameeni car insurance.

FAQs

What is the difference between third-party liability insurance and comprehensive insurance?

Third-party liability insurance only covers damage to other vehicles and property, while comprehensive insurance covers damage to your own vehicle as well.

How can I get a discount on my motor insurance?

Many insurance providers offer discounts for No-Claim Accident before which is known as NCD 10%-15% and if you renew before your insurance gets expired.

What should I do if I am involved in an accident?

Contact Najm or Muroor immediately and report the accident.

Cooperate with them and provide them with all the necessary details.

How can I file a claim?

Filling a claim is easy process in Saudi Arabia.

Have a Najm or Muroor report.

Find a Taqdeer centre.

Upload Taqdeer report online through Najm application.

Conclusion

So, there you have it.

Tameeni Car Insurance simplifies the process of comparing motor insurance prices in Saudi Arabia by providing a convenient platform to compare quotes from multiple insurance companies, isn’t it?

You have witnessed yourself tho.

By considering the factors affecting motor insurance premiums and understanding the differences between insurance types, you can make an informed decision that meets your needs and budget for sure.

Well, till the next time, I gotta go!

See you next time, don’t forget to share.