Four years ago, I landed in Riyadh, wide-eyed and optimistic, ready to tackle the desert sands and the exciting job market in Saudi Arabia.

One thing I quickly learned?

End of service benefits (ESB) also known as Gratuity in Saudi Arabia are more than just a bonus – they’re a lifeline.

In this land of golden dunes and soaring ambitions, understanding your end of service benefits can make the difference between a smooth transition and a financial sandstorm.

So, fellow expats, let’s ditch the dry legal jargon and get down to brass tacks.

How do you score that sweet lump sum upon saying goodbye to your employer?

Well, it all boils down to three things: time, salary, and a sprinkle of legalese.

Eligibility Criteria for End of Service Benefits

To be eligible for End of Service Benefits in Saudi Arabia, certain criteria must be met:

Minimum Service Period

Completion of at least two years of continuous service with the same employer is mandatory.

This ensures that employees who dedicate a significant portion of their career to a company are compensated for their loyalty.

Termination Reasons

The termination of employment should be due to retirement, resignation, or circumstances beyond the employee’s control (e.g., company closure, force majeure).

End of Service Benefits may not be granted if the termination is due to employee misconduct or breach of contract.

Formula of Calculating End of Service Benefits

The calculation of End of Service Benefits in Saudi Arabia is straightforward, based on the employee’s basic salary and years of service:

First Five Years

For each year of service within the first five years, half a month’s salary is awarded.

Exceeding Five Years

After five years, the benefit increases significantly, with one month’s salary granted for each subsequent year.

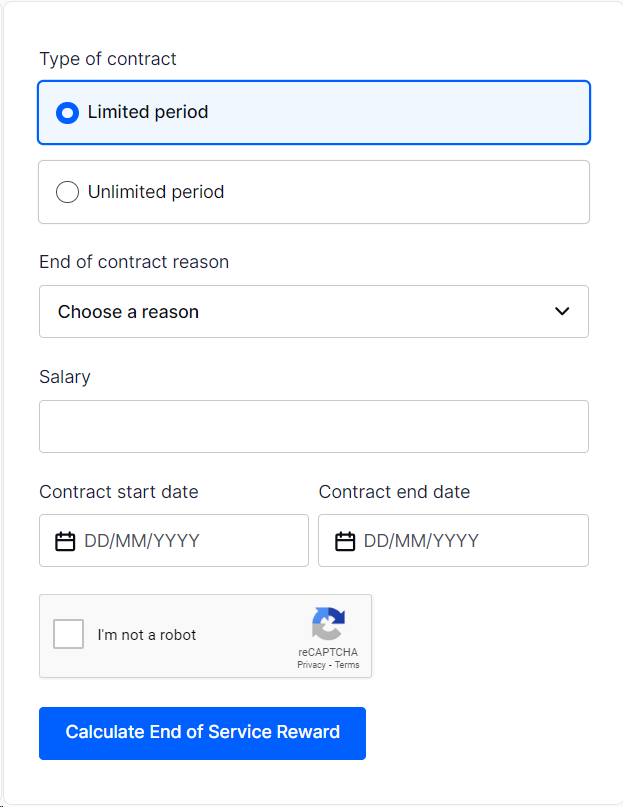

Calculating End of Service Benefits using Online Tools (Qiwa & MHRSD)

Ready to unlock your End-of-Service Benefits (ESB) with a few clicks?

MHRSD’s or Qiwa’s End of Service Calculator is here to make the process effortless!

Here’s your step-by-step guide:

- Visit the calculator’s online home at Labor Education, HRSD or Qiwa.

- Specify your contract type: Choose the option that matches your employment agreement: “Fixed Time” or “Unlimited Period“.

- Reveal the reason behind the ending: For Fixed Time contracts, select the applicable “End of Service Reason” from the list. For Unlimited Period contracts, do the same.

- Share your salary secrets: Input your gross salary.

- Count those years of service: Enter the duration of your employment in years. If you need more precision, feel free to add months and days as well.

- Press the magic button: Click the green button adorned with an equal sign, and watch the calculator work its magic!

- Uncover your ESB treasure: The calculator will proudly display your End of Service Benefits (Gratuity) right at the top, illuminating your financial path forward.

When you should get End of Service Benefits?

As per Saudi Labor Law, employers are obligated to settle End of Service Benefits within 30 days of the employment termination.

This ensures timely financial support for employees during the transition period.

Failure to comply with this timeline may result in penalties or legal action against the employer.

Expert Tips: Your Compass to a Smooth Transition

As your friendly neighborhood Riyadh blogger, here are some bonus tips to navigate the EOSB landscape with confidence:

- Document everything: Keep copies of your employment contract, salary slips, and any communication related to your job.

- Stay updated: Follow the MHRSD website and social media channels for the latest regulations and updates.

- Seek professional help: If you encounter any complexities with your EOSB calculations or face hurdles with your employer, don’t hesitate to seek professional help. Consider consulting a labor lawyer or a reputable financial advisor with expertise in Saudi labor laws. Their guidance can be invaluable in ensuring you receive your rightful compensation and navigate any legal disputes that may arise.

Frequently Asked Questions (FAQs)

I resigned. Am I still entitled to ESB?

Yes, employers can deduct legitimate debts owed by the employee from the benefits amount.

Are commissions included in the calculation?

While the standard calculation uses the gross salary, the Labor Law allows agreements to exclude commissions and certain variable wage components.

Do resignations due to force majeure qualify for ESB?

Yes, employees forced to resign due to circumstances beyond their control are entitled to full End of Service Benefits.

Can female employees terminated due to marriage or childbirth claim EOSB?

Yes, female employees whose contracts end within six months of marriage or three months after childbirth qualify for full EOSB.

What happens if my employer refuses to pay my EOSB?

No need to fret! You can file a complaint with the MHRSD. They’ll investigate and ensure your rights are protected.

Conclusion

Understanding End of Service Benefits in Saudi Arabia empowers both employers and employees for a smooth and transparent process.

By adhering to the provided information, employers can fulfill their obligations and employees can claim their rightful entitlements.

Remember, knowledge is your key to navigating the End of Service Benefits landscape effectively.

So, equip yourself with this guide and embark on your Saudi Arabian journey with confidence!

Don’t forget to share this article with your fellows to spread awareness about End of Service Benefits rights!

Leave a comment below with your questions or experiences with End of Service Benefits in Saudi Arabia.

Let’s work together to empower ourselves and thrive in the dynamic Saudi job market!