Saudi Arabia is welcoming foreign investors with open arms.

In 2018, it attracted a massive SR 13 billion in foreign direct investment.

The country is actively diversifying its economy, opening up sectors like logistics, health, education, and more.

Here’s a quick and easy guide to help you explore exciting opportunities to invest in Saudi Arabia.

Savings Account Investments

Explore options to invest in Saudi Arabia through banks like SAB, Bank Albilad, and Riyad Bank.

Websites like Souqalmal can help you compare and choose the best fit.

Pensions Investments

You don’t have to pay into the government’s insurance plan in Saudi Arabia.

Instead, you can choose alternatives like employer pension schemes or private pension plans.

Also read: Discover Affordable Health Insurance Options | Tameeni Insurance

Property Investments

The real estate market is growing, especially in cities like Riyadh, Jeddah, and Dammam.

Expats can buy property under certain conditions, but it’s important to follow the rules.

Business Investments

Foreign entrepreneurs are encouraged to invest in Saudi Arabia, especially in small and medium-sized enterprises (SMEs).

The setup process is becoming simpler, with support from entities like the Small and Medium Enterprises Authority.

Investment Funds

Look into mutual funds, ETFs, and bonds for investment in Saudi Arabia..

Companies like Jadwa Investment, Riyad Capital, and HSBC Islamic Global Equity Index Fund offer diverse investment options.

Offshore Investments

Unlike some places, Saudi Arabia doesn’t offer offshore investment options.

Stick to local opportunities.

The Saudi Stock Exchange is a big player.

While foreign individuals can’t directly trade, institutions often use brokerage services.

How to invest in Saudi Stocks as an Expat?

Expats living in Saudi Arabia can invest in Initial Public Offerings (IPOs) and trade shares through the Saudi Stock Market by opening a Tadawul account.

Here’s a straightforward process:

Eligibility

Expats can invest in the Saudi stock market and trade shares of listed companies on Tadawul.

The following individuals/entities are allowed to buy shares:

- Saudi Nationals.

- GCC nationals with a Saudi Bank account.

- Any business or company registered in Saudi Arabia.

- Iqama holders of Saudi Arabia.

Also read: The Ultimate Guide to Saudi Visa for GCC Residents

Steps to Open a Tadawul Account with SNB Al Ahli Account

- Wait for an IPO

- Stay updated on IPOs through the Tadawul website.

- Buy IPO Shares with SNB Al Ahli Account

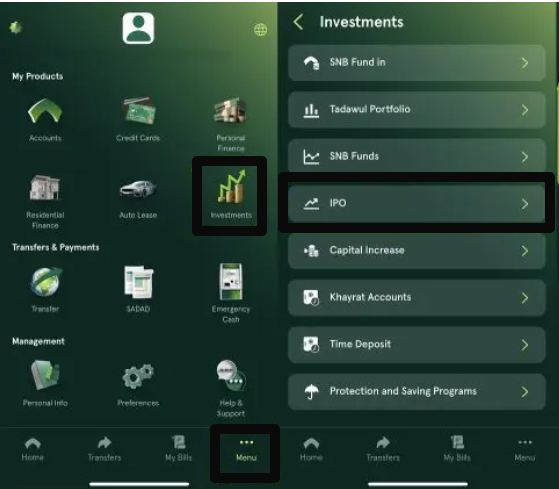

- Download the SNB Al Ahli app.

- Log in to your internet bank account.

- Navigate to “Menu” > “Investments” > “IPO.”

- Choose the company, enter the number of shares, and click “Confirm.”

- Receive Confirmation

- After a few days, you’ll receive an SMS confirming your IPO shares.

- Activate Tadawul Account

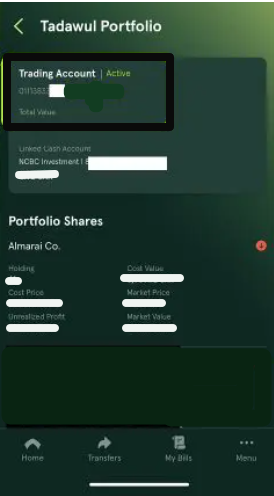

- Log in to the SNB Al Ahli Bank account.

- Navigate to “Menu” > “Investments” > “Tadawul Portfolio.”

- Note down your “Trading Account Number.”

- Complete Tadawul Account Setup

- Open Al Ahli Tadawul website.

- Click “Register in Saudi Market.”

- Agree to terms, enter Iqama Number, and input the “Portfolio Number.”

- You’re Ready to Invest

- Congratulations! You’ve successfully created a Tadawul account.

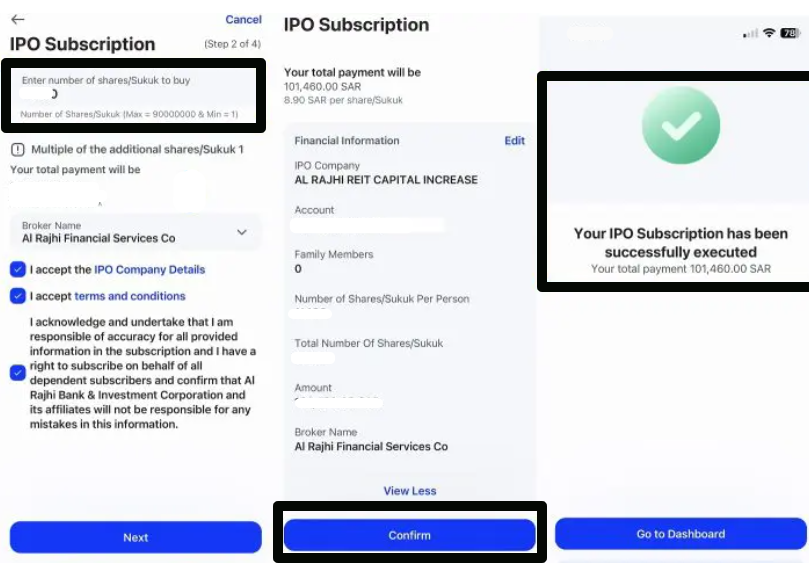

Steps to Open a Tadawul Account with Al Rajhi Bank

- Wait for an IPO

- Stay updated on IPOs through the Tadawul website.

- Buy IPO Shares with Al Rajhi Bank Account

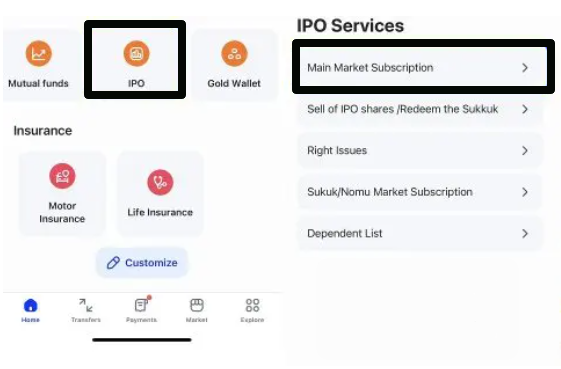

- Download the Al Rajhi app.

- Log in to your internet banking account.

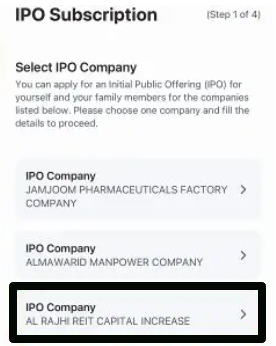

- Navigate to “IPO” > “Main Market Subscription.”

- Choose the company.

- Enter the number of shares, and Broker Name as Al Rajhi Financial Services Co.

- Now, click “Confirm.”

- Receive Confirmation

- After a few days, you’ll receive an SMS confirming your IPO shares.

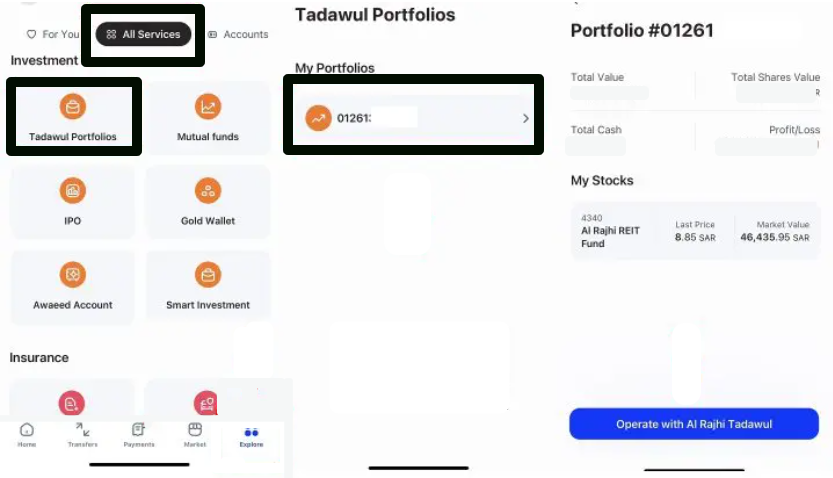

- Activate Tadawul Account with Rajhi

- Download the application.

- Log in to your internet banking account.

- Navigate to “Explore” > “All Services.”

- Note down your “Portfolio Number.”

- Complete Rajhi Capital Activation

- Install Rajhi Capital app.

- Register as a new user and complete the process.

- Log in to the Rajhi Capital website.

- Update KYC information on the website.

- Ready to Invest

- Congratulations! Your account with Al Rajhi Capital is now active, and you’re set to invest in the Saudi stock market.

Also read: How to Open Al-Rajhi Bank Account Online: 2024 Latest Method

Taxes and Tips to Invest in Saudi Arabia

- Good news – there’s no personal income tax! Just be aware of specific taxes on certain types of income.

- Consider factors like available opportunities, legal protection, geopolitical stability, and the strength of the financial system.

- Do your homework, stay informed, and seek advice from local experts.

Final Thoughts

So, as an expat, deciding to invest in Saudi Arabia means finding exciting opportunities in a growing economy.

The country welcomes foreign investors (like us) and with different sectors opening up, there are many ways to put your money to work.

Participating in the Saudi Stock Exchange lets you confidently explore the market and make smart investment choices.

Here’s to successful investing in Saudi Arabia!